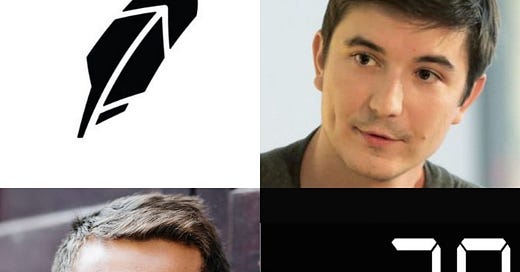

Robinhood Founder Vlad Tenev Shares 7 Nuggets Of Wisdom & Break your heart and keep it open with Jerry Colonna

Vlad Tenev, Co-Founder & CEO of Robinhood AND Jerry Colonna, Co-founder of Reboot

20VC: Robinhood Founder Vlad Tenev on The Single Most Important Thing Leadership is Responsible For, How To Manage Fear and Self-Doubt as a Leader & The Future of Fintech; Bundled or Unbundled

(November 30, 2020 - 36 minutes)

Vlad Tenev is the Co-Founder & CEO @ Robinhood, the company that provides commission-free investing, plus the tools you need to put your money in motion.

The Twenty Minutes VC - Venture Capital, Startup Funding, The Pitch

By Harry Stebbings - Founding Partner @ Stride.vc & Founder of 20VCMicrofund

ORIGIN STORY: VLAD TENEV

Hailing from Bulgaria, Vlad and his family narrowly escaped the collapse of its economy to the U.S. and with luck, furthered his education in the epicentre of innovation: Silicon Valley. Together with Baiji Bhatt whom he met at Stanford University, the duo founded a few financial companies during the 2008 financial crisis and advent of mobile technology with Robinhood as their defining product.

REDEFINING INVESTMENT

Vlad cultivated a deep appreciation for democracy, capitalism and innovation growing up, which became the cornerstones of Robinhood. He believed that the financial services industry would favour commission-free trades in the future. This is due to the minimal human component involved in the actual trading, which equated to low costs and improved accessibility via mobile devices.

RELATIONSHIPS WITH RISKS

Having the right mind-set will undoubtedly help with accepting lack of objective successes in challenging times. For Vlad personally, he accepted the risk of starting projects during the 2008 financial crises because he had nothing to lose at that moment as a Mathematics grad student with a potential future riddled with gruelling competition.

MARK OF A LEADER

Vlad shared that two responsibilities matter as a leader. The first is leading from the front and engaging with people doing the brunt of the work regardless of seniority. The second is balancing a high tempo of the company alongside high standards. This could be achieved through a sense of urgency with work so that the collective business could move faster and with better quality.

ON MANAGING FEAR & SELF-DOUBT

When these arise, leaders should introspect, learn the basics of their business operations and evolve with the company. As it scales, leaders should then optimise the performance of each teammate to their best roles. Vlad quoted good sleep, putting away his phone in a different room during bedtime and using a ‘dumb phone’ on the occasion help better tackle his fears and doubts.

PRO TIP: MENTORSHIP

Leaders should spend time with talents fresh out of school and those with limited experiences. In doing so, newcomers could be provided with direct mentorship, training and exposure to the company. Founders often make the mistake of overlooking their lack of experiences when they should be excited to share responsibilities with them.

THE FUTURE OF FINTECH: BUNDLED OR UNBUNDLED?

Vlad assesses that Fintech has grown into a complicated system and the more successful companies started out by focusing on a single trajectory. It is a cycle that begins with unbundling on a company basis then transitioning to bundling upon their launch of additional products. He also predicts that 2021 will see a diversification of investors and a shift from traditional spending ideas.

#114 Jerry Colonna: Break Your Heart and Keep it Open

(October 8, 2019 - 46 minutes)

Jerry Colonna is the author of Reboot: Leadership and the Art of Growing Up, and cofounder of Reboot – a coaching company.

Kent Lindstrom host of “Something Ventured” and Co-founder of 8-bit Capital

“Something Ventured“, behind the scenes interviews with Silicon Valley insiders

Jerry Colonna, bestselling author, Buddhist, and a sought-after coach for the most influential people in business and beyond, discusses his life and career.

Jerry was struggling with depression at the age of 38 when he was called a “Prince of New York”. After having suicidal feelings, he followed his therapists’ suggestion and went to a retreat. He felt that the inner version of and the outer version of him were not in sync.

He had a lifelong relationship with depression, having had a challenging childhood and a suicide attempt at 18. His advice is not to think that you understand someone's insides because you see what their outside is. He thinks it's very rare that any decision to take one's life is made impulsively.

This is one of the reasons why he thinks that sometimes it's good enough to build a company that just generates profit and provides jobs, even if it does not have an amazing return. It is often the wealthiest and most successful people that have inner struggles. He uses the metaphor of the Crow, which sits on one’s shoulder telling that they are not good enough. People try to shoot the Crow, even though it is trying to protect them, just in a perverse way. He thinks the solution is to face the Crow and convince it that they are strong enough and need no further protection.

Jerry has been journaling since he was 13 and later developed a meditational practice alongside Buddhism and reading constantly. His book resonated strongly with many, one of the most important lessons from it being that when a leader is willing to stand up and admit having difficulties, suddenly that creates space for others within the organization to step up and be honest about their problems.

He feels that the basic sense of unworthiness is still present in many people working in venture capital. He thinks that suffering is universal, and all beings are interdependent, which is an important Buddhist teaching. Much of our life is organized around protecting ourselves from heartbreak instead of letting it happen and opening the heart to the fullness of joy.

Thanks for reading. Reach us @Twitter / @Facebook with tips and feedback or by leaving a comment to our post here. Remember to share if you like what you read.

If you are hungry for more of Podtakes, do check out our Archive here for more.